Managing Refunds on a Policy

If a refund is generated for a policy and there are un-invoiced future charges on the policy term, refund amounts will be automatically allocated evenly to the remaining un-invoiced charges of the policy term.

When generating a refund, there can be two scenarios:

-

There are no un-invoiced charges in the policy term

-

If there are no un-invoiced charges on the policy term, the system will move the complete refund amount to the Bill to Party On Account Balance.

-

-

There are un-invoiced charges in policy terms for the policy

-

If there are un-invoiced charges on the policy term, the system will first adjust the refund amount with the un-invoiced charges of the policy term. If there is any surplus refund amount, then the refund amount will move to the On Account Balance for the Bill to Party.

-

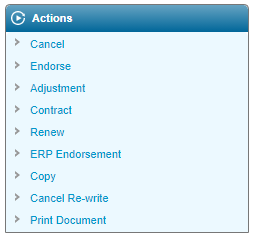

The following Actions/Transactions can generate a refund:

-

Void

-

Cancel

-

Cancel Re-write

-

Endorsement

-

Adjustment

-

Replacement

-

Policy Contraction

-

ERP Endorsement

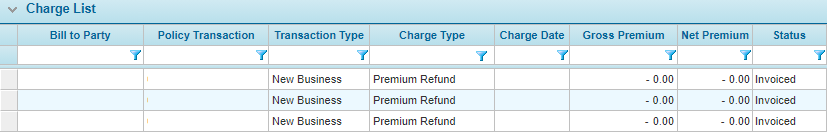

Charge Report

A Charge Type of Premium Refund is generated when there is a surplus left from the refund amount after un-invoiced charges of the policy term have been adjusted. The details of the charges are displayed in the Charge Report and Premium Refund charges are displayed with Booked status. The surplus amount of the refund appears in the Gross Premium column on the Charges Report.

Note that the Charge Date refers to the date the policy action was Bound and/or Confirmed.

To view the Charge Report, select Billing, Reports, then Charges.

Credit Invoice Generation

Once a Premium Refund charge is Booked, the system will generate a Credit Invoice containing the Premium Refund charges. The Credit Invoice is not sent to customers and displays the details of the premium refund as the following:

| Policy Number | The number identifying the policy. |

| Charge Date | The date the refund charge was generated. |

| Coverage | The coverage period in between the Effective Date and the Valid Until date. |

| Gross Premium | The gross calculated premium. |

| Net Premium | The net premium, not including taxes and fees. |

| Tax Amount | The calculated taxes and fees associated to the invoice. |

| Commission Amount | Percentage of the commission. |

| Total | Total amount of the credit invoice. |

| Outstanding Amount | Will appear as 0 since the amount moves to the On Account Balance of the Bill to Party. |

A credit invoice can be generated using the On Demand Invoicing method. For details on generating On Demand invoices, see the On Demand Invoicing section.

The system will create the Cash Receipt Batch with the Payment amount of 0 in order to move the credit invoice amount to the Bill to Party On Account Balance.

Viewing Details of the Cash Receipt

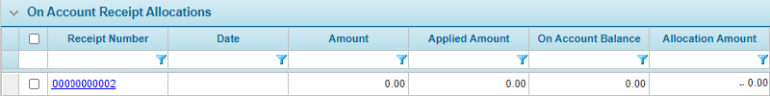

On Account Receipt Allocations

The Receipt Detailed Allocation screen will display both the details of the cash receipt and, if a policy term allocation occurs, the details of the invoice allocation.

To view the details of the Premium Refund, select Transactions, Batch Receipts, and select a Batch Number. In this screen, you may view the following details of the refund:

-

Bill to Party

-

Policy Term

-

Policy Transaction

-

Invoice Number

-

Receipt Amount

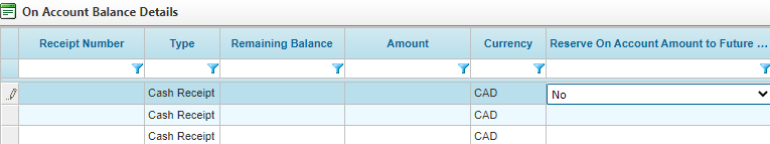

On Account Balance Details

You may view details of the refund receipts in the On Account Balance Details page of the Bill to Party. To view details of a receipt, select Billing, Bill to Parties, select a customer, select On Account Balance in the Bill to Parties menu, then select a currency. The following details may be displayed:

-

Receipt Number

-

Type

-

Date

-

Payment Method

-

Reference

-

Remaining Balance

-

Amount

-

Currency

In addition, for Reserve On Account Balance to Future Installments, you may select one of the following four options:

-

Yes - Premium Invoice

-

No

If you select Yes - Premium Invoice, the un-invoiced charges for future installments will be paid using the leftover refund amount. If you select No, the On Account Balance will be available to generate the Bill to Party Payable.

Manual Refund from On Account Balance

The system will allow the user to generate the premium refund by moving the refund amount the appropriate On Account Balance to either the Policy Term or the Bill to Party

From the Billing menu, click Bill to Parties, select a Bill to Party, select On Account Balance in the Bill to Parties menu, and then click on a currency link. From the Reserve On Account Amount to Future Installments drop down, select No.

The system moves the refund amount to the appropriate On Account Balance based on the action/transaction that triggered the refund. The amounts are moved to the On Account Balance accounts to pay un-invoiced charges as per the following:

| Void | Policy Term |

| Cancel | Policy Term |

| Endorsement | Policy Term |

| Cancel Re-Write | Policy Term |

| Adjustment | Policy Term |

| Replacement | Policy Term |

| Policy Contraction | Policy Term |

| ERP Endorsement | Policy Term |

General Ledger Entry

The system will create the general ledger entries on batch creation when moving the Credit Invoice amount to the On Account Balance. The following entries will appear in the General Ledger Accounts:

-

A new Debit entry has been created for the refund amount when Batch Receipt is of type Cash Receiptfor the transaction in the Account Receivable Account.

-

A new Credit entry has been created for the refund amount applied to Batch Receipts of type Cash Receipt when a refund is generated for the transaction in the Advance Premium Account